Despite global turbulences caused by COVID-19, the Singapore fintech industry remained resilient in 2020 on the back of new favorable rules, fintech initiatives from the government, and increased demand for digital solutions.

Over the past five years, the Singapore fintech ecosystem has grown rapidly, with exponential growth in the number of fintechs and people employed by them. According to new report by Oliver Wyman and Singapore Fintech Association (SFA), Singapore is now home to more than 1,000 fintech companies employing over 10,000 individuals.

Growth of number of fintechs and employees in 5 years, Singapore Fintech Landscape in 2020 and Beyond, Oliver Wyman, Singapore Fintech Association, Dec 2020

COVID-19 boosts fintech business

Singaporean fintech companies have overall benefited from the digitalization push that came with the COVID-19 pandemic.

An industry survey conducted earlier this year found that 66% of fintechs saw an increase in demand in their business during COVID-19, and 40% believe that the increase is likely to be sustained over a longer period of time.

Local digital payments startup MatchMove told the Financial Times in September that the number of inquiries from companies wanting to digitalize their payment system had “shot up 10 times” from the beginning of the year and that staff couldn’t keep up.

Fintech adoption is projected to increase in the near future with about 73% of Singaporean businesses expecting to use at least one fintech product or services within the next 12 months, a regional survey by professional accounting body CPA Australia found. Businesses cited motivations including increased efficiency, improved customer experience and ensuring business continuity.

Fintech funding bounces back

Like other parts of the world, fintech funding in Asia took a hit amid the global pandemic. But the funding landscape in Singapore has remained somewhat less volatile, according to the Oliver Wyman/SFA study.

Fintech funding declined to US$68 million in Q1 2020 to but significantly rebounded in Q2 2020 to reach US$278 million. This represents more than 11.5% of all fintech funding in Asia for the quarter.

Comparison of FinTech investments in Asia versus Singapore, Singapore Fintech Landscape in 2020 and Beyond, Oliver Wyman, Singapore Fintech Association, Dec 2020

Though fintech funding activity remains largely dominated by early-stage rounds, especially when compared to more developed fintech markets like the US and China, later-stage funding is appearing as the market continues to mature.

Deal share by stage for FinTechs in 2019, Singapore Fintech Landscape in 2020 and Beyond, Oliver Wyman, Singapore Fintech Association, Dec 2020

MAS ramps up support for fintech startups amid COVID-19

To help the fintech sector stay afloat during the pandemic, the Monetary Authority of Singapore (MAS) launched two major support packages for fintechs.

The first, announced on April 8, 2020, is a S$125 million COVID-19 care package for the financial and fintech sectors aimed at helping businesses support their workers, enhance operational readiness and resilience, accelerate digitalization and boost capabilities.

COVID-19 Fintech Care Package Infographic, Source: Monetary Authority of Singapore (MAS)

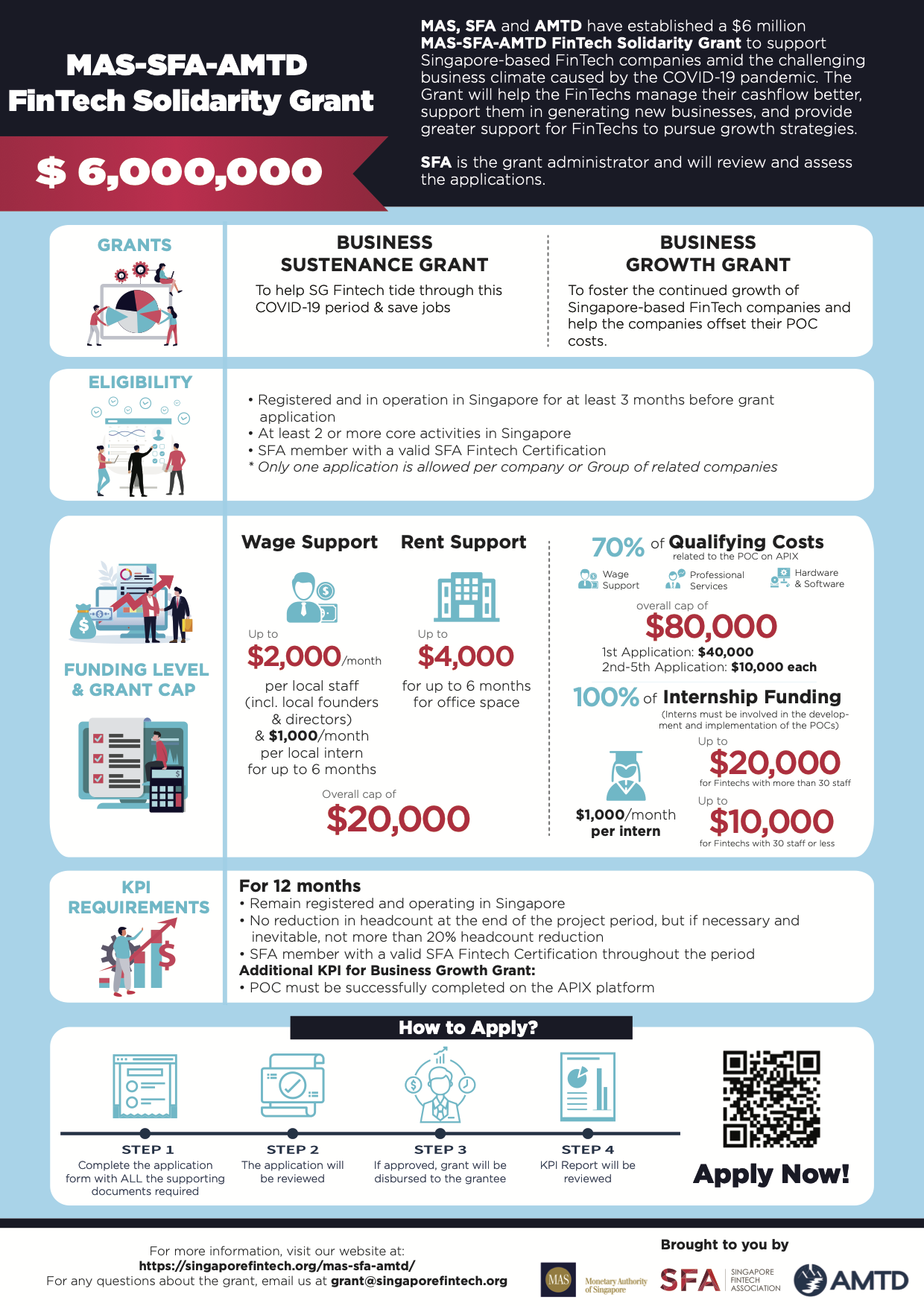

The second initiative, called the MAS-SFA-AMTD Fintech Solidarity Grant, was launched on May 13 by MAS, SFA and AMTD Foundation (AMTD), and seeks to support Singapore-based fintech firms in managing cashflow, generate new businesses, and pursue growth strategies.

MAS-SFA-AMTD Fintech Solidarity Grant Infographic, Source: Monetary Authority of Singapore (MAS)

Singapore’s first digital banks unveiled

A highly anticipated fintech development that took place this year was the granting of the city state’s first digital banking licenses.

BUT gave the greenlight to four applicants in December: the Grab-Singtel consortium, technology giant Sea, China’s Ant Group, and a consortium comprising Greenland Financial Holdings, Linklogis Hong Kong and Beijing Co-operative Equity Investment Fund Management.

The two first were granted digital full banking licenses, allowing them to offer retail customer services such as account opening, deposits as well as debit and credit cards. They are also allowed serve corporate customers.

The other two were awarded digital whole banking licenses, allowing them to serve corporates and small and medium-sized enterprises (SMEs).

All four digital banks are expected to go live by early 2022, according to a Straits Times report.

A focus on blockchain, green finance and open banking

At the annual Singapore Fintech Festival (SFF), MAS stressed its commitment towards blockchain, green finance and open banking.

The event saw the launch of a new S$12 million blockchain research program that aims to accelerate development and adoption of the technology, as well as the introduction of Project Greenprint, a new tech platform that connects SMEs and fintech companies working on green and sustainable projects to financial institutions and investors.

SFF 2020 also saw the launch of the Singapore Financial Data Exchange (SGFinDex), the city state’s take on open banking.

SDFinDex is a public digital infrastructure that uses Singapore’s National Digital Identity (SingPass) to allow citizens to obtain their financial information from different financial institutions and government agencies.

Leveraging SGFinDex, Singaporeans can consolidate all of their finances through financial planning services offered by financial institutions as well as through MyMoneySense, a free financial planning digital service offered by the Singapore government. This allows for a more holistic view and understanding of one’s finances, MAS said.

The regulator plans to expand the platform to insurance policies as well as the stock market in the near future.

SGFinDex Infographic, Source: MAS, Dec 2020

New fintech regulations

The Payment Services Act came into force on January 28, 2020, providing a single, activity-based and risk-specific legislation for payment-related services in Singapore.

The new law consolidates existing payments regulatory frameworks and introduces new types of licensable payment services. It also includes a licensing regime for digital asset exchange and platforms.

In July, MAS proposed new regulation that would expand its supervisory powers in a range of areas including additional powers to take enforcement action against individuals, to apply new licensing requirements to certain types of virtual asset service providers, and to impose technology risk management requirements.