In today’s fast-moving business world, companies are shifting from old payment methods like checks and wire transfers to digital B2B payments. This change started during the COVID-19 pandemic when remote work became necessary, and now it’s growing faster than ever thanks to new technology.

According to McKinsey & Company, over 70% of B2B companies are planning to use digital payment systems to save time, reduce costs, and grow faster. Let’s explore why this trend is gaining popularity and how it helps businesses grow.

Why Companies Are Switching to Digital B2B Payments

It’s Faster and Easier

Sending a payment through a check or wire transfer can take several days. Digital payments are made with a few clicks and are often processed within minutes. This saves time and makes the process smooth for both sides.

Stronger Security

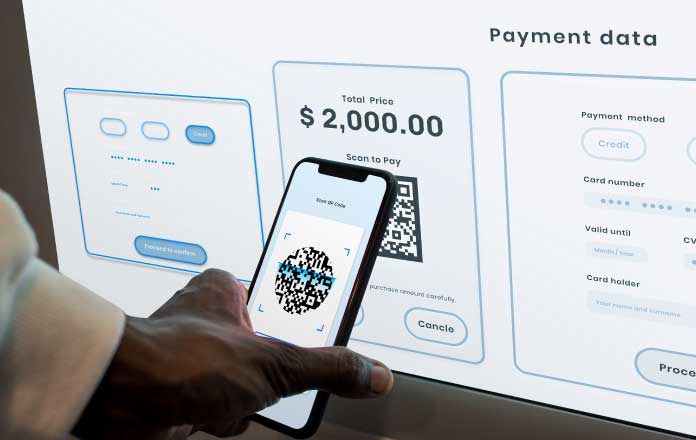

Old payment methods are more likely to be targeted by fraud. Digital payments use advanced security tools like encryption and two-step authentication.

Did you know? A 2024 report by PwC found that 62% of finance leaders saw fewer cases of fraud after moving to digital payments.

Lower Costs

Sending paper checks costs money—printing, mailing, and processing all add up. Digital payments cut those costs by doing everything online. Plus, they reduce errors and the need for manual work.

Clear and Simple Tracking

With digital payments, businesses can see where their money is at any time. They can easily check payment status, track cash flow and keep better records, which helps them make smart financial decisions.

How Digital B2B Payments Help Businesses Grow

-

Get Paid Faster

Digital payments help businesses receive money faster, which improves cash flow. This means companies can pay their own bills on time and avoid late fees.

-

Better Cash Flow Management

When payments are fast and easy to track, managing cash becomes easier. Businesses can plan better, avoid shortages and grow with confidence.

-

Improved Customer and Partner Experience

Clients and suppliers prefer fast and straightforward payments. Digital payments create a better experience for everyone involved by reducing delays and offering more flexible options.

-

Less Manual Work, More Efficiency

Digital systems can be connected to software like QuickBooks or SAP, so everything runs automatically. This reduces manual data entry, cuts down errors, and saves staff time.

What’s Next for B2B Payments?

In the coming years, we expect to see more businesses using tools like AI (artificial intelligence), blockchain, and real-time international payments. These innovations will make B2B transactions even safer, faster, and more reliable.