A new research conducted by the Asian Development Bank Institute (ADBI) has revealed a correlation between financial literacy and fintech adoption in Vietnam. The report calls for the country to put more effort into general and financial education programs to rise fintech adoption and consequently help improve financial inclusion.

Financial inclusion has become a global issue and is often considered being key to addressing poverty reduction and social inequality. Though Vietnam’s financial and banking system has made significant progress in recent years, financial inclusion remains a major challenge with more than half of the population still not having a bank account, reports the Hanoi Times.

With hopes that technology would help improve financial inclusion, the government has been supporting cashless payments and digital financial services with initiatives including an electronic payments push announced in 2017, as well as a national financial inclusion strategy approved in January.

Financial literacy in Vietnam

But before fintech can enable and empower populations in developing countries, financial literacy must improve, especially at a time when developments in technology are complexifying financial products.

The ADBI research, which surveyed 1,058 households in Vietnam, found that those who use fintech services have higher levels of financial literacy compared to those who do not use any fintech services.

Across three fintech services, namely e-banking, e-payment and e-transfer, fintech adopters were systematically found to have higher levels of knowledge and understanding of financial principles.

Fintech Adoption and Financial Literacy Scores, Source: Fintech and Financial Literacy in Vietnam, Asian Development Bank Institute, June 2020

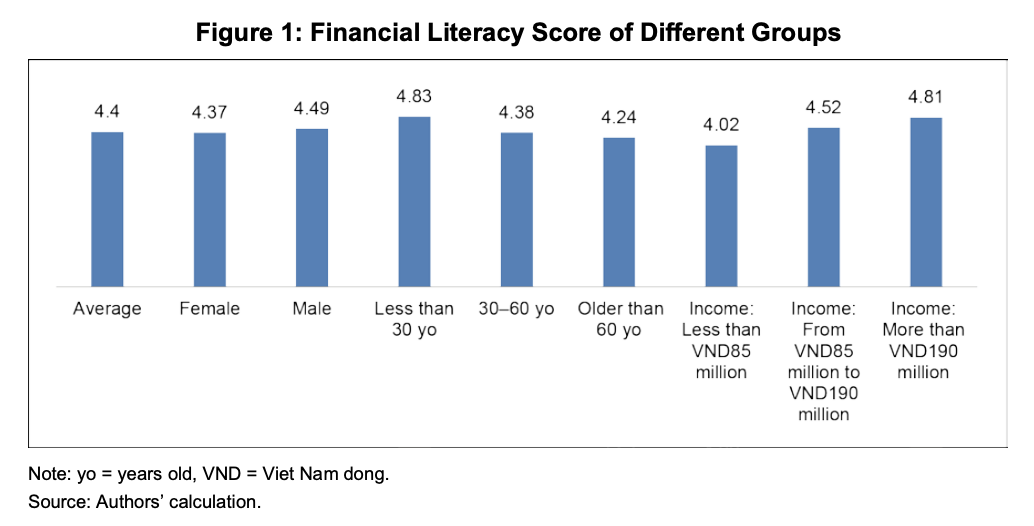

The research also found that financial literacy varies depending on income level and age, with younger, wealthier populations being more knowledgeable. Households with an annual income of less than 85 million VND scored 4.02 out of 7, below the national average. In comparison, those with an annual income of more than 190 million VND were found to be amongst the most knowledgeable, scoring 4.81 out of 7. Across all different groups, respondents aged less than 30 years old have the higher score in financial literacy at 4.83 out of 7.

Financial Literacy Score of Different Groups, Source: Fintech and Financial Literacy in Vietnam, Asian Development Bank Institute, June 2020

This implies that despite the promise of improving financial inclusion, digital financial services are failing to reach impoverished and disadvantaged communities because of low financial literacy.

Fintech awareness and adoption in Vietnam

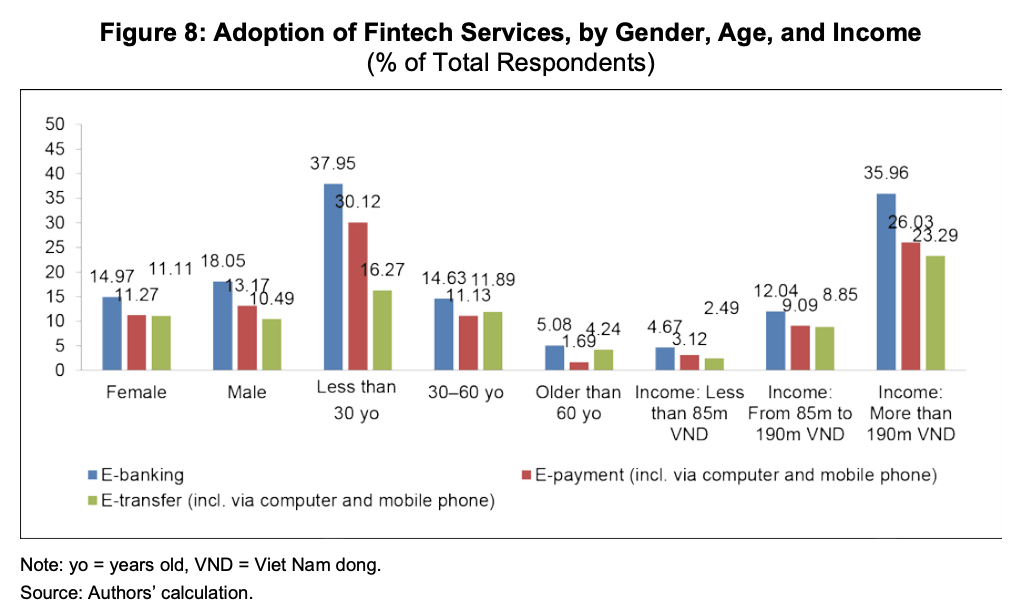

Results show that in addition to being more financially literate, the younger and higher-income populations are also the biggest adopters of fintech products.

The proportion of younger people aged less than 30 years old using fintech services was found to be much higher than that amongst older people. Out of the respondents aged less than 30 years old, 37.95% use e-banking and 30.12% use e-payments. In comparison, only 5.08% of those more than 60 years old use e-banking, and only 1.69% of them use e-payments.

Like financial literacy, fintech adoption also varies depending on income level. The research found large differences in adoption rates between the top income group and the middle, and lower-income groups. Out of those in the low-income group (annual household income less than 85 million VND), only about 3% use at least one fintech service. In comparison, about 23-35% of those in the high-income group (annual household income of more than 190 million VND) use at least one fintech product.

Adoption of Fintech Services, by Gender, Age, and Income, Source: Fintech and Financial Literacy in Vietnam, Asian Development Bank Institute, June 2020

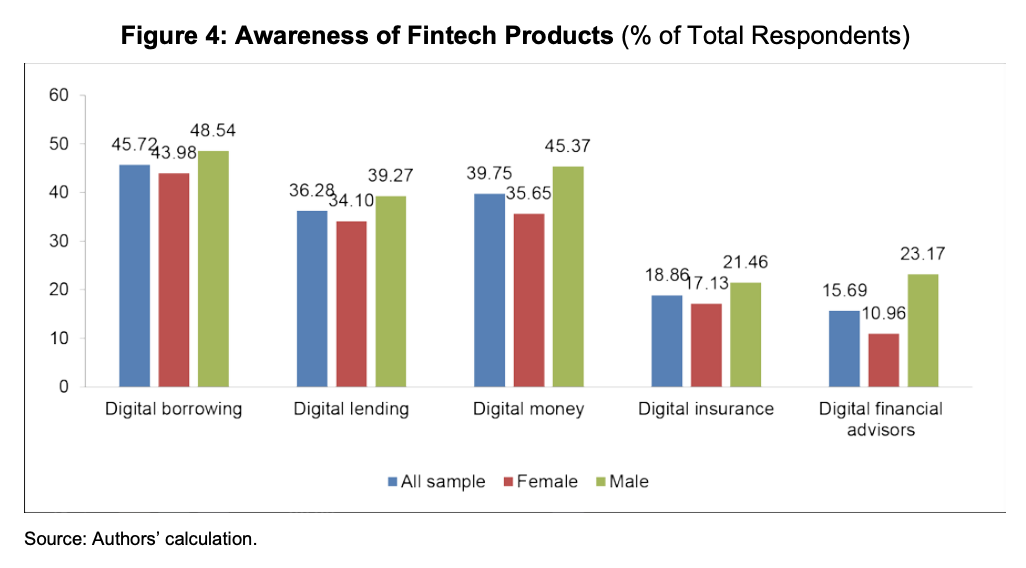

Across all age and income groups, Vietnamese were found to be most aware of digital borrowing (45.7%), followed by digital money and e-wallets (39.8%) and digital lending (36.3%). Only 18.9% and 15.7% of respondents are aware of digital insurance and digital financial advisors, respectively.

Awareness of Fintech Products, Source: Fintech and Financial Literacy in Vietnam, Asian Development Bank Institute, June 2020

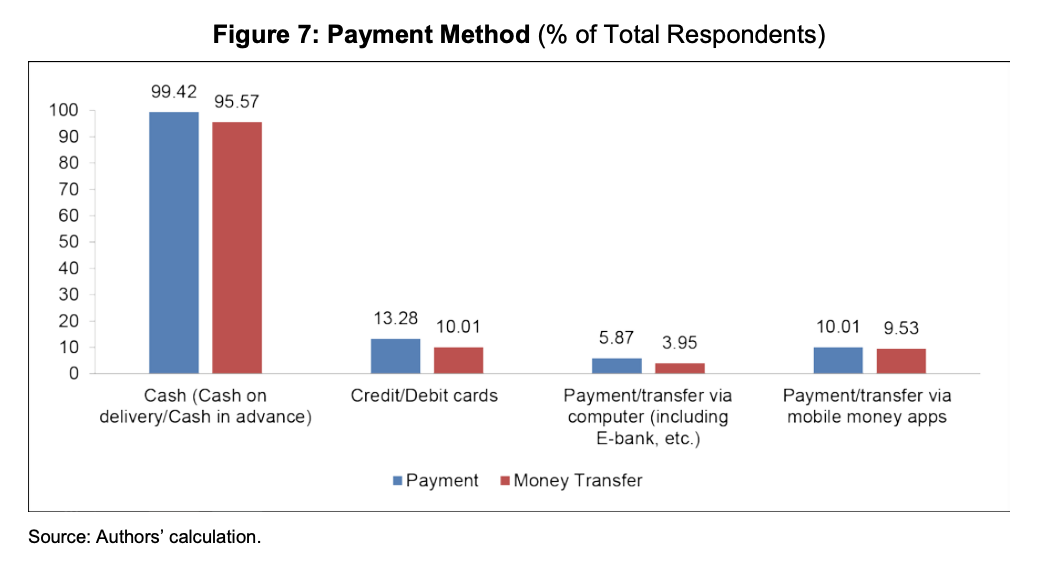

Cash remains the dominant means of transactions in Vietnam with 99.42% of respondents reporting using it for payments. Around 13% use credit/debit cards, and only about 10% use mobile phones.

Payment Method, Source: Fintech and Financial Literacy in Vietnam, Asian Development Bank Institute, June 2020

Featured image credit: Pexels