It may be a challenge for brands in highly-regulated spaces, but meeting customer expectations is both possible and essential. To get there, marketers need to ensure that they strike the right balance between data privacy/security and innovation. Let’s explore the best practices of how brands in financial services can make the customer engagement journey as smooth and secure as possible.

Building out an effective customer journey is an essential part of the long-term success of any brand in today’s increasingly in-the-moment, mobile-first world. For financial services brands, implementing this kind of data-driven customer engagement program requires two key elements:

- Taking steps to make sure data privacy concerns are addressed

- Ensuring compliance when it comes to in-the-moment customer messaging

1. Ensuring Data Privacy

Traditional banks are well aware of the challenges associated with data privacy, because they’ve had to adhere to some of the world’s most stringent data privacy standards for many years. With the ever-growing number of touchpoints that exist between mobile devices, websites, social accounts, in-person branch visits, and more, maintaining data privacy going forward is going to require fundamental changes that legacy technologies, operations, and siloed organizations simply aren’t built to handle.

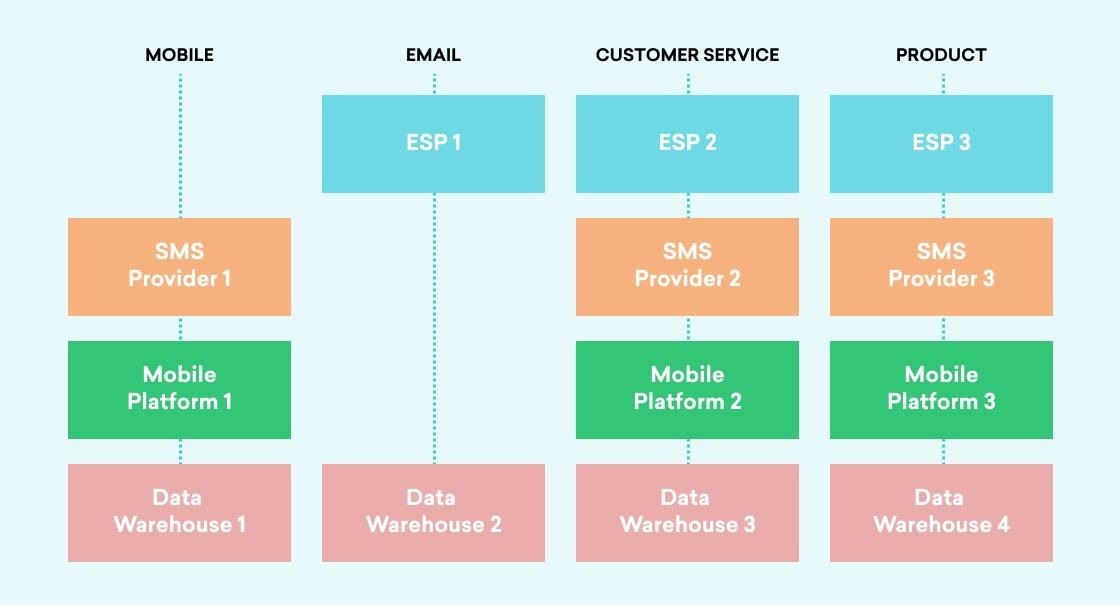

Historically, the marketing departments at traditional financial institutions have primarily been product and/or channel-focused, rather than holistic in nature. This may not seem like a data privacy issue on the surface, but siloed organizations tend to suffer from saturated and disjointed marketing technology stacks, resulting in a chaotic distribution of data that can expose organization to data privacy risks over time.

To avoid this outcome, financial services brands need to ensure that their marketing technology stack can support true data agility, providing teams with a holistic view of the data at their disposal and making it easier to carry out effective data management and privacy practices.

2. Maintaining Compliance When Communicating with Customers

Many banks and financial institutions leverage batch static data processing across a variety of systems that eventually feed in information that will later be sent to customers. One of the major risks associated with standard data processing is that it can be hard to ensure that the information that results from it is accurate and up to date.

For example, imagine that a bank’s marketing team has been asked to help boost the volume of international money exchanges at the institution’s local branches. To make this happen, they decide to send a promotional email highlighting a new two-week low in exchange rates to a group of US-based customers who recently purchased a ticket to Mexico through a credit card rewards program, encouraging them to visit their local branch versus a third-party currency exchange provider.

While this is a great idea for a campaign, the team will only see results if the information informing it is up to date—after all, exchange rates can change quickly, so if the bank uses batch data processing (rather than real-time streaming data), they run the risk of including outdated or inaccurate information in their customer communications, potentially putting them out of compliance.

While this sort of real-time messaging campaign may seem complex at first glance, it is actually simple if you have the right strategy and technology. With a dynamic content feature like Braze Connected Content, you can customize campaigns across multiple different channels with personalized information from your company’s own internal servers and third-party APIs—allowing the marketing team in our example to simply pull the exchange rate information at send-time, so there is no risk that the information is out of date. Even better, the data being leveraged via Connected Content is encrypted at rest and in transit and is not ever stored on the Braze platform, making it easy to safeguard the information.

The long and short of it? While compliance can often feel like a burden, it is also a sacred responsibility for brands. Your customers deserve accurate, relevant campaigns that do not waste their time or put their information at risk—and if you live up to that standard, it can go a long way to establish humanized, honest conversations with your customers.

Braze: A Trusted, Creditable Partner

Customer data is essential to today’s best marketing programs—but if that data is not being provided directly by consumers who have explicitly opted in to share it, a lot of the benefits can be lost. Braze platform has been developed to help marketers request this kind of first-party data transparently and then act on it to put customer value at the forefront.

Braze has built security and privacy controls into the core of our product. We take pride in maintaining the highest standards of compliance with data protection regulations and security standards: third-party penetration tests, SOC II and ISO 27001 compliance audits, and ensuring that our system is ready when new privacy regulations are implemented.

Braze has a longstanding commitment to helping customers comply with relevant data protection laws and regulations and we continue to do what it takes to ensure that our technology makes effective, compliant brand experiences possible.