The Singapore Fintech Festival (SFF) 2020 took place between December 7 to 11 this year, featuring a unique hybrid format that combined a 24-hour online platform with satellites events around the world.

The 2020 week-long fintech gathering included more than 600 sessions over five days, 1,400 speakers, more than 1,000 exhibitors, 27 international pavilions, and more than 60,000 participants representing over 7,000 global companies from more than 130 countries.

Like previous years, Singapore Fintech Festival 2020 saw several major announcements being made, including product launches, fintech partnerships, and updates on key initiatives

These exciting news come on the heels of the granting of the first four digital bank licenses in Singapore, a landmark development in the city-state’s fintech industry but also in the broader Southeast Asian region.

New S$12 million blockchain program

Enterprise Singapore (ESG), Infocomm Media Development Authority (IMDA), the National Research Foundation Singapore (NRF), and supported by the Monetary Authority of Singapore (MAS), launched the Singapore Blockchain Innovation Programme (SBIP), a S$12 million national blockchain research program aimed at strengthening Singapore’s blockchain ecosystem.

The program will work on expanding blockchain research to the needs of the industry and will look into scalability and interoperability of blockchain solutions.

SBIP will engage close to 75 companies to conceptualize 17 blockchain related projects within the next three years in sectors starting with trade and logistics, and supply chain.

Singapore Blockchain Innovation Programme, via sbip.sg

Singapore blockchain industry continues to mature

Singapore continued to see its blockchain industry grow in 2020 with in-house blockchain projects progressing towards full-scale deployment and startups moving towards more mature funding stages, a study by OpenNodes, Temasek, IBM, PwC Singapore, EY and SGTech, supported by IMDA and MAS, found.

The research, released during the SFF 2020, gives an overview of the domestic blockchain space, shares key trends and developments, and offers an updated version of the Singapore Blockchain Landscape Map.

Singapore becomes hotbed for B2B fintechs

Singapore is rapidly becoming a hotbed for business-to-business (B2B) fintechs, a position that’s being reinforced by the city state’s strong network of partners, according to the Singapore Fintech Landscape 2020 and Beyond report, released during SFF 2020 by Oliver Wyman and Singapore Fintech Association (SFA).

Fintechs in Singapore are using the country as a launchpad into the rest of Southeast Asia. They are focused on a multi-country strategy with a strong appetite for overseas expansion, the research found.

Consolidating Singaporeans’ financial information with SGFinDex

MAS and the Smart Nation and Digital Government Group (SNDGG) launched on December 7, the Singapore Financial Data Exchange (SGFinDex), a public digital infrastructure that centralizes Singaporeans’ financial information to help them plan their finances holistically.

The platform allows citizens to sign-in using their national digital identity (SingPass) and provide consent to obtain their financial information from different financial institutions and government agencies.

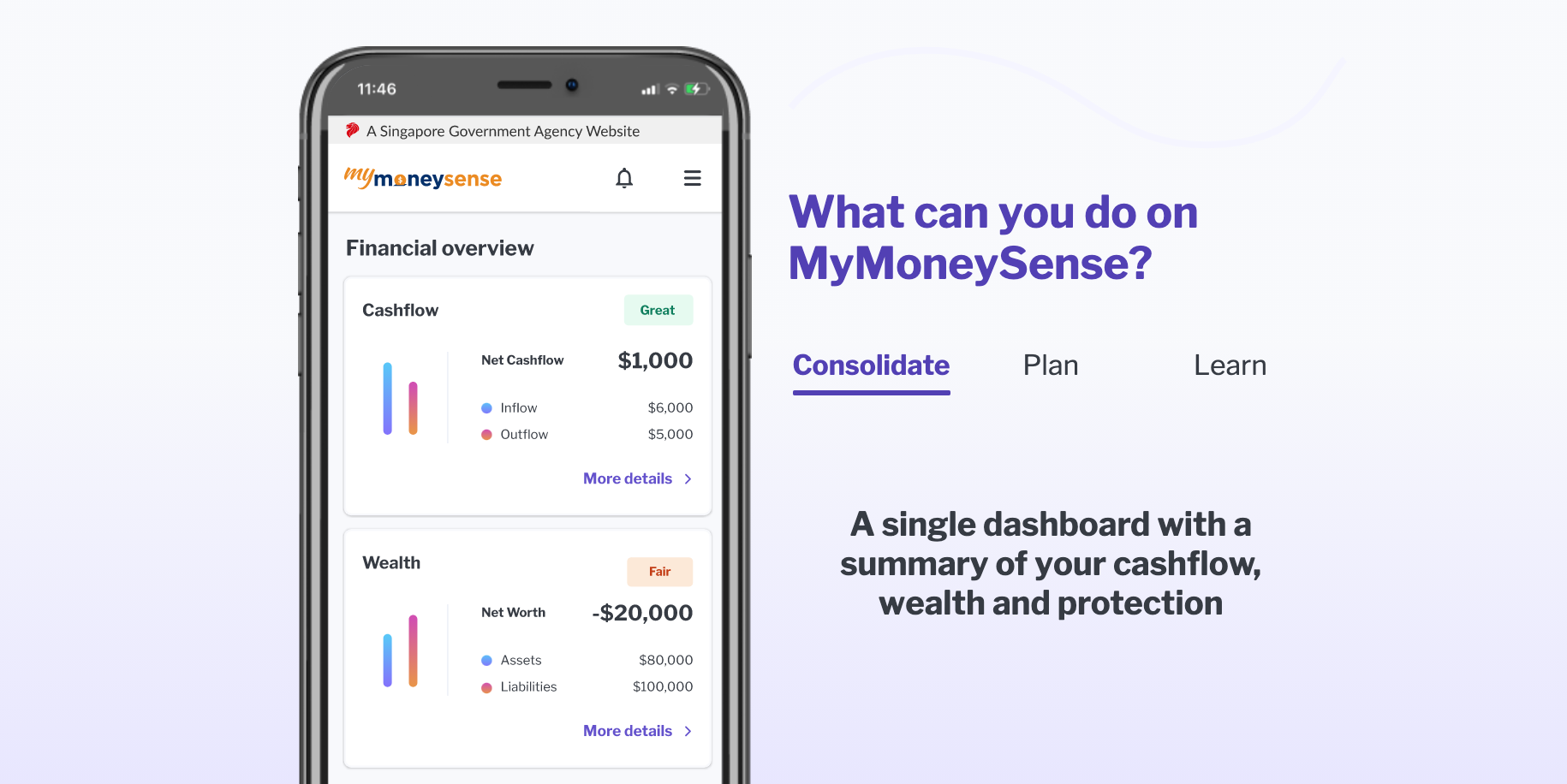

Singaporeans can view their consolidated financial information through financial planning services offered by financial institutions or MyMoneySense, a free financial planning digital service offered by the Singapore government.

MAS said the next phase of SGFinDex will involve allowing Singaporeans to get access to information on their insurance policies and their holdings of stock at the Central Depository.

MyMoneySense mobile app, via mymoneysense.gov.sg

Singapore-Thailand mobile payment linkage to go live in mid-2021

By mid-2021, users of PayNow, Singapore’s national payment system, and PromptPay, Thailand’s national payment system, will be able to make cross-border payments between the two countries using just their mobile numbers.

The mobile payment linkage project between Singapore and Thailand was initiated three years ago. MAS said it was interested in partnering with other central banks in the region to expand the linkage.

ASEAN fintechs continue to grow despite COVID-19 uncertainties

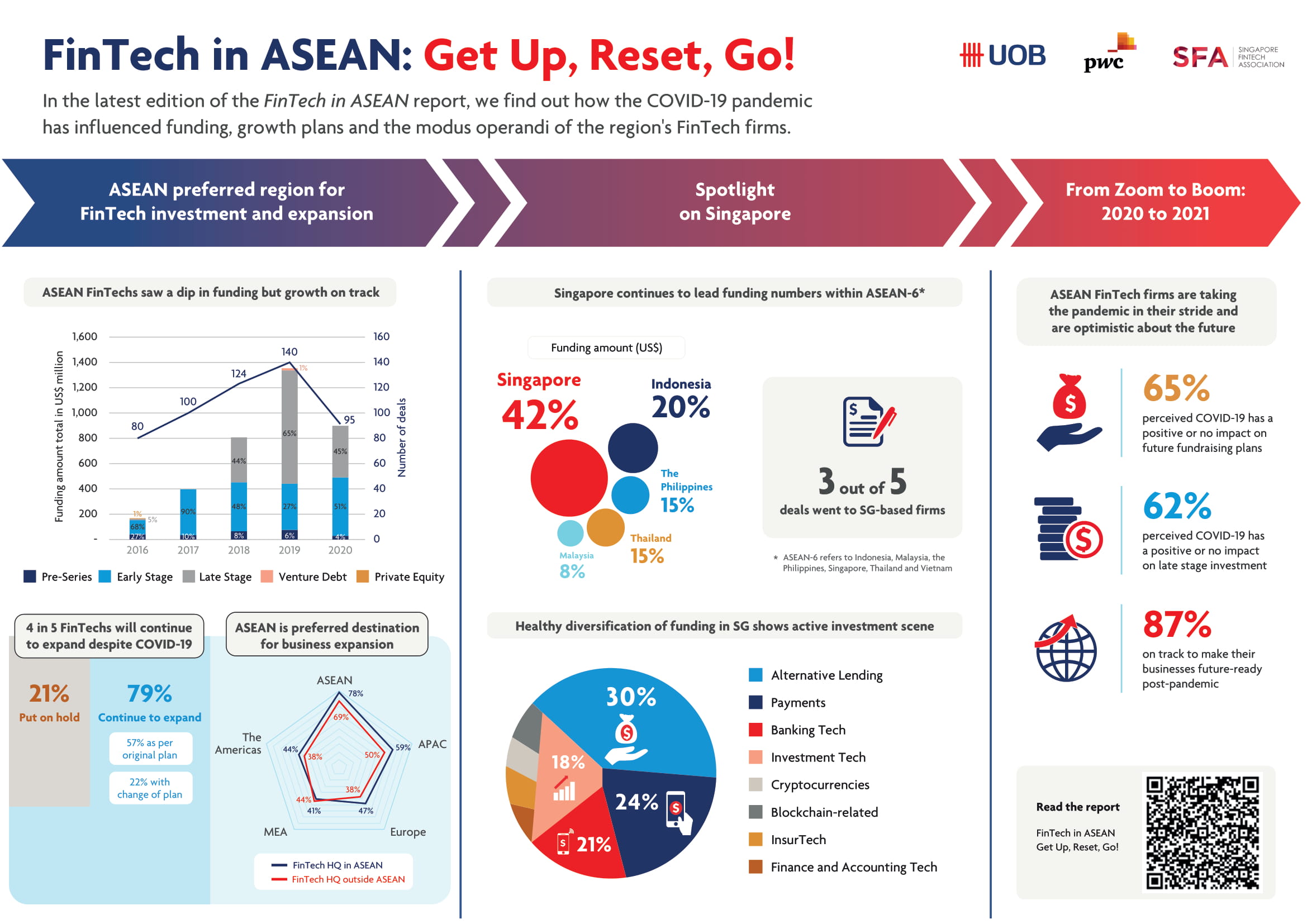

Despite disruptions brought about by the COVID-19 pandemic, fintech companies in ASEAN will push ahead with their expansion plans in the next two years, found a new study by UOB, PwC and SFA.

Rapid digital adoption is bring unprecedented opportunities for fintech companies in ASEAN to provide the region’s growing digitally-connected population with digital financial solutions in areas such as payments and alternative lending, the report says.

Fintech in ASEAN, UOB, PwC and the Singapore Fintech Association

Fintech partnerships and collaborations

MAS unveiled several bilateral fintech partnerships during SFF 2020. The collaboration with the Bank of Ghana (BOG) aims to foster closer relationships between small and medium-sized enterprises (SMEs) and financial institutions of Singapore and Ghana via Business sans Borders and Financial Trust Corridor.

With the central bank of Hungary, Magyar Nemzeti Bank (MNB), MAS seeks to help fintech firms access each other’s markets and exchange views on fintech trends and more.

With China, MAS will build on existing areas of collaboration and facilitate financing and investment activities in support of a post-COVID-19 recovery in Singapore and China through initiatives on digital finance, green finance and capital markets.

Finally, MAS’ partnership with the United Nations Development Programme (UNDP) Global Centre for Technology, Innovation and Sustainable Development will seek to equip SMEs with financial and digital tools.

These solutions and resources include Cultiv@te, an agritech program by UNDP, Business sans Borders (BSB), an open and global digital infrastructure for trade discovery and digital business services connectivity, and API Exchange (APIX), an MAS-supported cross-border, open innovation API platform.

The partnership will also focus on helping Singaporean fintechs expand to developing countries within the UNDP’s global network of 170 offices.

Update on Project Ubin

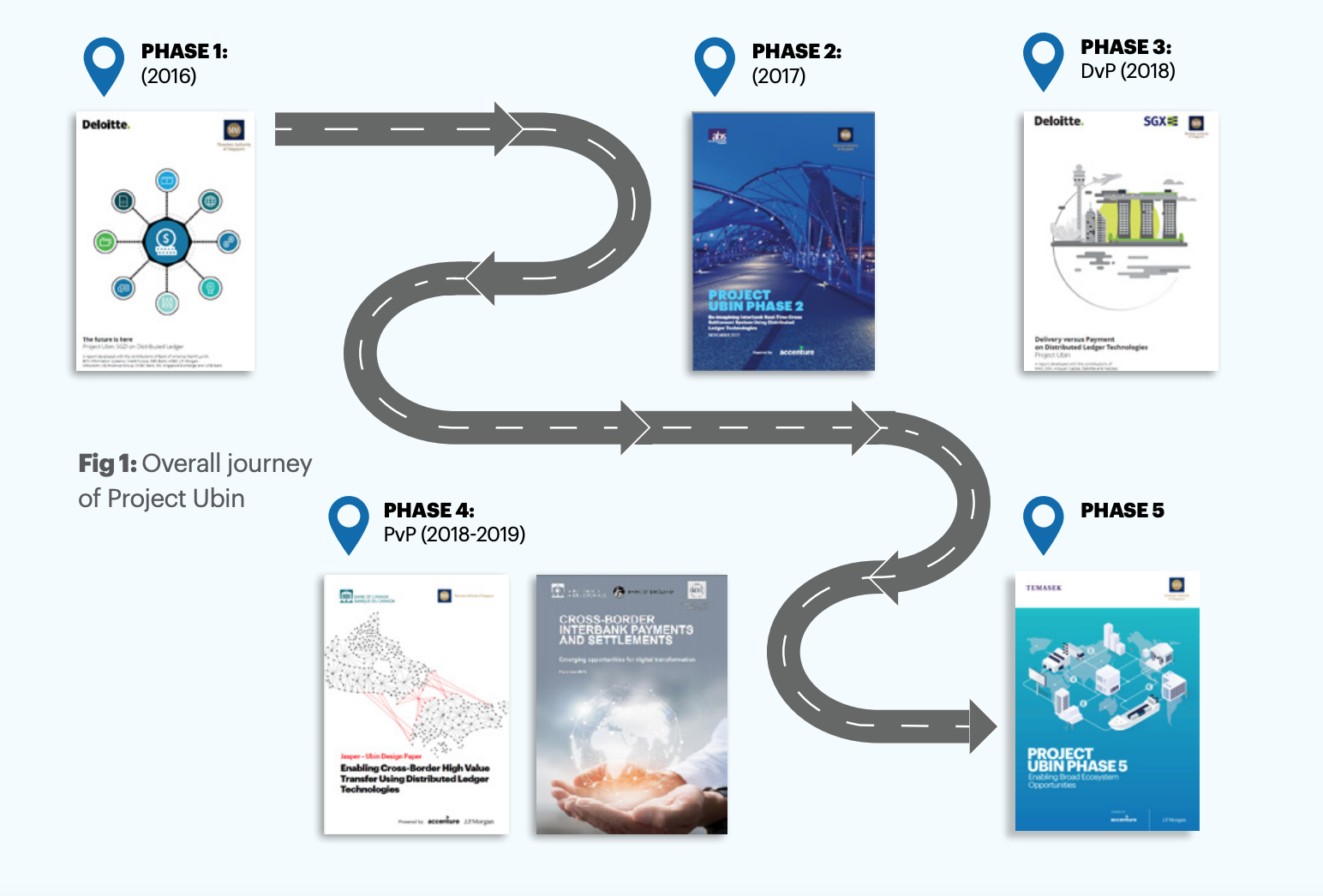

Project Ubin, which has been running for five years now, successfully tested a blockchain-based prototype for multi-currency settlement in July.

Industry players are now moving from experimentation towards commercialization, with DBS Bank, JP Morgan and Temasek leading the development of a digital multi-currency payments network.

Pilot trials will commence in 2021.

Illustration via Project Ubin Phase 5: Enabling Broad Ecosystem Opportunities

MAS embarks on Project Greenprint

BUT officially embarked on Project Greenprint, a technology platform aimed at promoting a green financial ecosystem. With Project Greenprint, MAS seeks to provide a platform for SMEs and fintech companies working on green and sustainable projects to connect with financial institutions and investors.

MAS said it will earmark 20% of the Financial Sector Technology and Innovation budget, or US$37 million out of US$185 million, to support green fintech projects in general.

MAS released guidelines on environmental risks management

In parallel to SFF 2020, MAS released three sets of guidelines on environmental risk management for banks, insurers and asset managements.

These guidelines cover environmental risks including climate change, pollution, loss of biodiversity, and changes in land use, addressing topics such as governance and strategy, disclosure of environmental risk information, underwriting, risk management, investment, stewardship, and more.

Winners of the 2020 Fintech Awards and Global Fintech Hackcelerator announced

The winners of the 2020 Global Fintech Hackcelerator and the Fintech Awards were announced on December 10.

The three winners of the Global Fintech Hackcelerator – Matter, RegulAltion and Intensel – bagged S$50,000 in prize money each, while the 12 winners of the 2020 Fintech Awards, were awarded a total of S$1.2 million, with cash prizes ranging from S$50,000 to S$150,000 for each company.

The annual Fintech Awards recognize fintech innovators and leaders across four categories – Singapore Founder, ASEAN Fintech, Singapore Financial Institution, and Global – while the Global Fintech Hackcelerator recognizes startups that created solutions that address the challenges faced by the financial industry.

Winners of 2020 MAS Fintech Awards and Global Fintech Hackcelerator, @sgfintechfest, via Twitter

Featured image credit: Deputy Prime Minister of Singapore Heng Swee Keat gives his Opening Address at SFFxSWITCH 2020